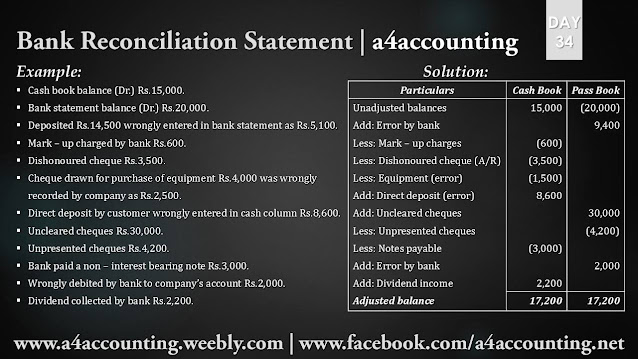

(1) Debit Balance of Cash Book:

Bank account is an asset for company and asset has normally debit balance. Cash book shows that bank account has a debit balance it means it has a positive balance.(2) Debit Balance of Bank Statement:

For banks, customer's account is a liability and liability has a credit balance. Here bank statement shows debit balance which means negative balance.

(3) Error by Bank:

Company deposited Rs.14,500 into bank account but ban wrongly added in the company's account only Rs.5,100. It means bank added less amount as deposited by the company. For correction, bank will add further amount Rs.9,400. So it will be added in bank statement.

(4) Mark - up:

Mark - up charged by the bank but not recorded in the company's book so it will be deducted from the cash book as decrease in bank account.

(5) Dishonoured Cheque:

Cheque returned by the bank so it will be deducted from the cash book.

(6) Error by Company:

Equipment purchased for Rs.4,000 but wrongly recorded as Rs.2,500 it means company recorded less amount on payment side of cash book. For correction, it will be deducted from cash book Rs.1,500 as reduction in ban balance.

(7) Direct Deposit by Customer (Error):

Customer directly deposited into bank account should be added in the bank column of cash book by the company but company wrongly recorded this amount in the cash column of cash book. So it will be added in the bank column of cash book for rectification.

( 8) Uncleared Cheques:

Cheques deposited but not cleared by the bank. It will be added in bank statement.

(9) Unpresented Cheques:

Cheques issued but not presented to the bank for payment. It will be deducted from the bank statement.

(10) Notes Payable:

Bank paid a note payable on behalf of the company but did not recorded by the company. So it will be recorded by the company as deduction from cash book.

(11) Error by Bank:

Bank wrongly deducted amount from the company's account. It will be added in the bank statement as error made by bank.

(12) Dividend Income:

Dividend collected by the bank for company but did not recorded in the company's cash book. It will be added in the company's cash book as increase in the bank account.

Comments

Post a Comment